2024 Allen Matkins Survey | Key Takeaways

Increased Optimism in Key Regions:

- Sentiment indexes for multifamily housing development have reached their highest levels in the last two years.

- Notable optimism is seen in San Francisco, Silicon Valley, East Bay, Los Angeles, Orange County, San Diego, Sacramento/San Joaquin, and the Inland Empire.

- Los Angeles, Orange County, and San Diego, in particular, have shifted from neutral to optimistic outlooks.

Development Plans and Financing:

- While new multifamily development plans have slightly decreased from Summer 2023, they show an increase compared to Winter 2024.

- Expectations for higher equity requirements and investment return thresholds have marginally decreased.

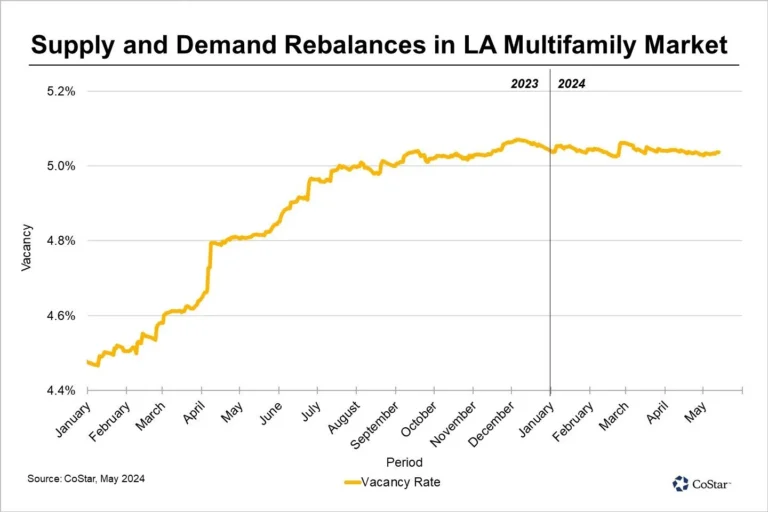

Rental and Vacancy Rate Projections:

- Rental rates for multifamily units are anticipated to rise across California over the next three years.

- Vacancy rates are expected to decline in all regions except for Sacramento/San Joaquin, where they are projected to remain stable.

Economic and Market Context:

- The survey reflects an economic environment where GDP growth surged to 5.1%, and commercial real estate development saw expansion.

- Despite concerns about rising financing costs, the multifamily housing market remains robust.

- Significant new developments in multifamily housing are likely to begin in 2025 and 2026.

Summary for Investors: The multifamily housing market in California shows a strong, optimistic outlook, especially in major regions like Los Angeles and Orange County. While financing costs are a concern, the market is expected to remain robust, with rental rates climbing and vacancy rates decreasing.