Total Mortgage Debt:

-

-

Commercial/multifamily mortgage debt surged to $4.70 trillion.

-

Multifamily mortgage debt alone grew by $23.7 billion (1.1%) to reach $2.10 trillion.

-

Major Holders:

-

-

Commercial Banks: Hold the largest share at $1.8 trillion (38%).

-

Agency and GSE Portfolios and MBS: The second-largest holders with $1.01 trillion (22%).

-

Life Insurance Companies: Hold $720 billion (15%).

-

CMBS, CDO, and Other ABS Issues: Account for $604 billion (13%).

-

Multifamily Mortgage Debt:

-

-

Agency and GSE Portfolios and MBS: Largest holders at $1.01 billion (48%).

-

Banks and Thrifts: Hold $620 billion (30%).

-

Life Insurance Companies: Account for $230 billion (11%).

-

State and Local Government: Hold $117 billion (6%).

-

CMBS, CDO, and Other ABS Issues: Hold $67 billion (3%).

-

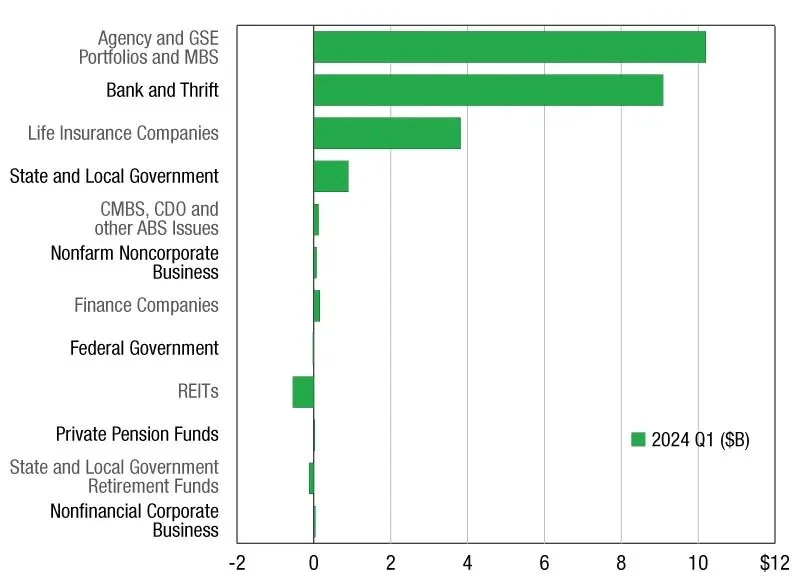

Changes in Debt Holdings

-

-

Banks and Thrifts: Increased holdings by $12.8 billion (0.7%).

-

CMBS, CDO, and Other ABS Issues: Grew by $11.0 billion (1.9%).

-

Agency and GSE Portfolios and MBS: Increased by $10.2 billion (1.0%).

-

Life Insurance Companies: Expanded holdings by $7.0 billion (1.0%).

-

Percentage Growth

-

CMBS, CDO, and Other ABS Issues: Saw the highest percentage increase at 1.9%.

-

State and Local Government Retirement Funds: Experienced a decline in holdings by 8.3%.

*Credit Multi-Housing News